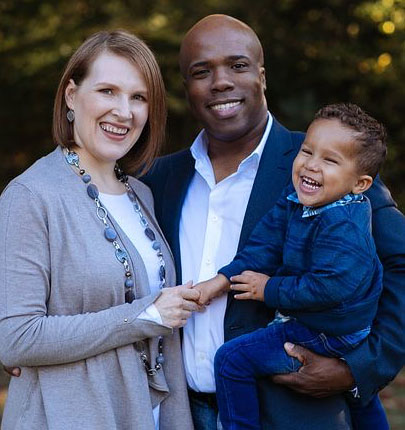

Life insurance gives your family choices by providing the money to help pay off debts, make mortgage payments, help fund college educations for your children or grandchildren, and much more. Life insurance provides cash when it's needed most.

Affordable investment solutions for retirement, college, life, and emergency savings.

We offer a FREE fincancial needs analysis designed to customize your road to finanical freedom which focuses on investments, paying down debt, and savings.

The average American household has less than $2000 in savings and a staggering $16,000 in credit card debt. Without an adequate life insurance policy the family suffers not just an emotional loss, but a financial one. Ask yourself, could you afford your lifestyle on one income? Would you have enough to continue to live where you live? How would your children's lives change?

We stand in the gap with solutions so our clients don't face these financial hardships. You will have a team available to you and your family 7 days a week, not an automated phone number. We offer contact free appointments via zoom or if you prefer we can come to your home at your convenience.

Get a Quote

Life insurance helps ensure that a single person’s debt’s won’t get passed on to surviving parents and family members

The additional money can also provide financial support for aging parents, siblings, or other family members

Single parents are the sole caregivers & breadwinners for their children

With so much responsibility resting on their shoulders, single parents need to make sure that they have enough life insurance to help safeguard their children’s financial futures

Does the family have enough savings to pay down debt and maintain their standard of living for the next 10, 20, or 30 years?

These are important questions to consider when purchasing life insurance